Abstract

We analyze the relationship between corporate social responsibility and the stock market performance in the post-global financial crisis period. A new measure of social responsibility by Thomson Reuters, called the ESG Combined Score, is used. As a novel feature of our analysis, socially responsible engagement is divided into the strategic activities closely related to the examined companies’ core business and the remaining secondary activities. The results of the fixed effects regression show a positive and statistically, as well as economically, significant impact of the strategic activities on the corporate stock market performance of companies. This impact is up to 103% higher compared to the secondary activities. The empirical results suggest that if companies aim to increase their share prices via the corporate social responsibility channel, they should strategically select their socially responsible initiatives.

Similar content being viewed by others

Data Availability

The data that support the findings of this study are available from the Refinitiv Eikon database (Thomson Reuters, 2021, accessed 2021-01-28). Restrictions apply to the availability of these data, which were used under license for this study. Data are available at https://eikon.thomsonreuters.com with the permission of Thomson Reuters.

Notes

Please note that due to the logarithmic nature of the dependent variable, the precise interpretation of the estimated coefficient of the non-logaritmized independent variable follows: an increase of the independent variable by 1 (small) unit is associated with a change of the dependent variable by \(\big (exp({\widehat{\beta }})-1\big ) \times 100\) percent. This is often approximated by \({\widehat{\beta }} \times 100\) percent. However, such simplification holds well only for ‘very small’ values of \({\widehat{\beta }}\).

References

Abbott, W. F., & Monsen, R. J. (1979). On the measurement of corporate social responsibility: self-reported disclosures as a method of measuring corporate social involvement. Acad. Manag. J., 22(3), 501–515.

Arellano, M. (1987). PRACTITIONERS’ CORNER: computing robust standard errors for within-groups estimators. Oxford Bull. Econ. Stat., 49(4), 431–434.

Bansal, P., & Song, H.-C. (2017). Similar but not the same: differentiating corporate sustainability from corporate responsibility. Acad. Manag. Ann., 11(1), 105–149.

Barnett, M. L., & Salomon, R. M. (2006). Beyond dichotomy: the curvilinear relationship between social responsibility and financial performance. Strategic Manag. J., 27(11), 1101–1122.

Baron, D. P. (2001). Private politics, corporate social responsibility, and integrated strategy. J. Econ. Manag. Strategy, 10(1), 7–45.

Barth, M. E., Beaver, W. H., & Landsman, W. R. (1992). The market valuation implications of net periodic pension cost components. J. Account. Econ., 15(1), 27–62.

Bénabou, R., & Tirole, J. (2010). Individual and corporate social responsibility. Economica, 77(305), 1–19.

Bowen, H. R. (1953). Social Responsibilities of the Businessman. New York: Harper & Row.

Bowman, E. H., & Haire, M. (1975). A strategic posture toward corporate social responsibility. CA Manag. Rev., 18(2), 49–58.

Brammer, S., & Millington, A. (2008). Does it pay to be different? An analysis of the relationship between corporate social and financial performance. Strategic Manag. J., 29(12), 1325–1343.

Brown, S. J., Lajbcygier, P., & Li, B. (2008). Going negative: what to do with negative book equity stocks. J. Portfolio Manag., 35(1), 95–102.

Burbano, V. C. (2016). Social responsibility messages and worker wage requirements: field experimental evidence from online labor marketplaces. Org. Sci., 27(4), 1010–1028.

Carroll, A. B. (1981). Business and Society: Managing Corporate Social Performance. Boston: Little Brown and Company.

Chatterji, A. K., Durand, R., Levine, D. I., & Touboul, S. (2015). Do ratings of firms converge? Implications for managers, investors and strategy researchers. Strategic Manag. J., 37(8), 1597–1614.

Chatterji, A. K., Levine, D. I., & Toffel, M. W. (2009). How well do social ratings actually measure corporate social responsibility? J. Econ. Manag. Strategy, 18(1), 125–169.

Cheng, B., Ioannou, I., & Serafeim, G. (2014). Corporate social responsibility and access to finance. Strategic Manag. J., 35(1), 1–23.

Clark, J. M. (1939). Social Control of Business. New York: McGraw-Hill.

Cochran, P. L., & Wood, R. A. (1984). Corporate social responsibility and financial performance. Acad. Manag. J., 27(1), 42–56.

De Klerk, M., de Villiers, C., & van Staden, C. (2015). The influence of corporate social responsibility disclosure on share prices: evidence from the United Kingdom. Pac. Account. Rev., 27(2), 208–228.

DesJardine, M., Bansal, P., & Yang, Y. (2019). Bouncing back: building resilience through social and environmental practices in the context of the 2008 global financial crisis. J. Manag., 45(4), 1434–1460.

Durand, R., Paugam, L., & Stolowy, H. (2019). Do investors actually value sustainability indices? Replication, development, and new evidence on CSR visibility. Strategic Manag. J., 40(9), 1471–1490.

Eccles, R. G., Ioannou, I., & Serafeim, G. (2014). The impact of corporate sustainability on organizational processes and performance. Manag. Sci., 60(11), 2835–2857.

Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. J. Financ. Econ., 33(1), 3–56.

Flammer, C. (2015). Does corporate social responsibility lead to superior financial performance? A regression discontinuity approach. Manag. Sci., 61(11), 2549–2568.

Flammer, C. (2018). Competing for government procurement contracts: the role of corporate social responsibility. Strategic Manag. J., 39(5), 1299–1324.

Flammer, C., & Luo, J. (2017). Corporate social responsibility as an employee governance tool: evidence from a quasi-experiment. Strategic Manag. J., 38(2), 163–183.

Freeman, R. E. (1984). Strategic Management: A Stakeholder Approach. Boston: Pitman.

Godfrey, P. C. (2005). The relationship between corporate philanthropy and shareholder wealth: a risk management perspective. Acad. Manag. Rev., 30(4), 777–798.

Gond, J.-P., Palazzo, G., & Basu, K. (2009). Reconsidering instrumental corporate social responsibility through the Mafia metaphor. Business Ethics Q., 19(1), 57–85.

Gregory, A., Tharyan, R., & Whittaker, J. (2014). Corporate social responsibility and firm value: disaggregating the effects on cash flow, risk and growth. J. Business Ethics, 124(4), 633–657.

Griffin, J. M., & Lemmon, M. L. (2002). Book-to-market equity, distress risk, and stock returns. J. Finance, 57(5), 2317–2336.

Hausman, J. A. (1978). Specification tests in econometrics. Econometrica, 46(6), 1251–1271.

Hausman, J. A., & Taylor, W. E. (1981). Panel data and unobservable individual effects. Econometrica, 49(6), 1377–1398.

Hawn, O., Chatterji, A. K., & Mitchell, W. (2018). Do investors actually value sustainability? New evidence from investor reactions to the Dow Jones sustainability index (DJSI). Strategic Manag. J., 39(4), 949–976.

Hillman, A. J., & Keim, G. D. (2001). Shareholder value, stakeholder management, and social issues: what’s the bottom line? Strategic Manag. J., 22(2), 125–139.

Hull, C. E., & Rothenberg, S. (2008). Firm performance: the interactions of corporate social performance with innovation and industry differentiation. Strategic Manag. J., 29(7), 781–789.

Inoue, Y., & Lee, S. (2011). Effects of different dimensions of corporate social responsibility on corporate financial performance in tourism-related industries. Tour. Manag., 32(4), 790–804.

Ioannou, I., & Serafeim, G. (2015). The impact of corporate social responsibility on investment recommendations: analysts’ perceptions and shifting institutional logics. Strategic Manag. J., 36(7), 1053–1081.

Jan, C.-L., & Ou, J. A. (2012). Negative-book-value firms and their valuation. Account. Horizons, 26(1), 91–110.

Khan, M., Serafeim, G., & Yoon, A. (2016). Corporate sustainability: first evidence on materiality. Account. Rev., 91(6), 1697–1724.

KLD Research & Analytics, Inc., KLD database (2019). http://www.whartonwrds.com/datasets/kld/

Koh, P.-S., Reeb, D. M., & Zhao, W. (2018). CEO confidence and unreported R&D. Manag. Sci., 64(12), 5725–5747.

Kramer, M. R., & Porter, M. (2011). Creating shared value. Harvard Business Rev., 89(1/2), 62–77.

Kreps, T.J.: Measurement of the social performance of business. In: An Investigation of Concentration of Economic Power for the Temporary National Economic Committee, Monograph No. 7, Washington, DC: American Enterprise Institute for Public Policy Research (1940).

Luo, X., & Bhattacharya, C. (2006). Corporate social responsibility, customer satisfaction, and market value. J. Market., 70(4), 1–18.

Lydenberg, S., Rogers, J., Wood, D.: From transparency to performance: industry-based sustainability reporting on key issues (2010). https://bit.ly/3ryITrp

Makni, R., Francoeur, C., & Bellavance, F. (2009). Causality between corporate social performance and financial performance: evidence from Canadian firms. J. Business Ethics, 89(3), 409.

Refinitiv. (2020a) Refinitiv ESG Scores. https://www.refinitiv.com/en/sustainable-finance/esg-scores

Refinitiv. (2020b). Refinitiv ESG Scores (backup for 2020 methodology in .pdf). https://bit.ly/3hY2I8q

Sustainability Accounting Standards Board (2021), SASB Materiality Map. https://www.sasb.org/

Thomson Reuters (2017), Thomson Reuters ESG Scores 2017. https://bit.ly/2HAiBA2

Thomson Reuters (2021), Eikon database. https://eikon.thomsonreuters.com

McGuire, J. B., Sundgren, A., & Schneeweis, T. (1988). Corporate social responsibility and firm financial performance. Acad. Manag. J., 31(4), 854–872.

McWilliams, A., & Siegel, D. (2000). Corporate social responsibility and financial performance: correlation or misspecification? Strategic Manag. J., 21(5), 603–609.

Moneva, J. M., Rivera-Lirio, J. M., & Muñoz-Torres, M. J. (2007). The corporate stakeholder commitment and social and financial performance. Ind. Manag. Data Syst., 107(1), 84–102.

Moskowitz, M. (1972). Choosing socially responsible stocks. Business Soc. Rev., 1(1), 71–75.

Ohlson, J. A. (1995). Earnings, book values, and dividends in equity valuation. Contemp. Account. Res., 11(2), 661–687.

Perrini, F., Russo, A., Tencati, A., & Vurro, C. (2011). Deconstructing the relationship between corporate social and financial performance. J. Business Ethics, 102(1), 59–76.

Porter, M. E., & Kramer, M. R. (2006). The link between competitive advantage and corporate social responsibility. Harvard Business Rev., 84(12), 78–92.

Qiu, Y., Shaukat, A., & Tharyan, R. (2016). Environmental and social disclosures: link with corporate financial performance. Br. Account. Rev., 48(1), 102–116.

Revelli, C., & Viviani, J.-L. (2015). Financial performance of socially responsible investing (SRI): what have we learned? A meta-analysis. Business Ethics, 24(2), 158–185.

Schadewitz, H., & Niskala, M. (2010). Communication via responsibility reporting and its effect on firm value in Finland. Corp. Soc. Resp. Environ. Manag., 17(2), 96–106.

Scherer, A. G., & Palazzo, G. (2011). The new political role of business in a globalized world: a review of a new perspective on CSR and its implications for the firm, governance, and democracy. J. Manag. Stud., 48(4), 899–931.

Seele, P., & Lock, I. (2015). Instrumental and/or deliberative? A typology of CSR communication tools. J. Business Ethics, 131(2), 401–414.

Servaes, H., & Tamayo, A. (2013). The impact of corporate social responsibility on firm value: the role of customer awareness. Manag. Sci., 59(5), 1045–1061.

Siegel, D. S., & Vitaliano, D. F. (2007). An empirical analysis of the strategic use of corporate social responsibility. J. Econ. Manag. Strategy, 16(3), 773–792.

Spicer, B. H. (1978). Investors, corporate social performance and information disclosure: an empirical study. Account. Rev., 53(1), 94–111.

Sturdivant, F. D., & Ginter, J. L. (1977). Corporate social responsiveness: management attitudes and economic performance. CA Manag. Rev., 19(3), 30–39.

Tirole, J. (2001). Corporate governance. Econometrica, 69(1), 1–35.

Van der Laan, G., Van Ees, H., & Van Witteloostuijn, A. (2008). Corporate social and financial performance: an extended stakeholder theory, and empirical test with accounting measures. J. Business Ethics, 79(3), 299–310.

Vance, S. C. (1975). Are socially responsible corporations good investment risks. Manag. Rev., 64(8), 19–24.

Vassalou, M., & Xing, Y. (2004). Default risk in equity returns. J. Finance, 59(2), 831–868.

Waddock, S. A., & Graves, S. B. (1997a). The corporate social performance-financial performance link. Strategic Manag. J., 18(4), 303–319.

Waddock, S. A., & Graves, S. B. (1997b). Quality of management and quality of stakeholder relations: are they synonymous? Business Soc., 36(3), 250–279.

Zhao, X., & Murrell, A. J. (2016). Revisiting the corporate social performance-financial performance link: a replication of Waddock and Graves. Strategic Manag. J., 37(11), 2378–2388.

Acknowledgements

Jiri Kukacka gratefully acknowledges financial support from the Charles University PRIMUS program [project PRIMUS/19/HUM/17] and from the Charles University UNCE program [project UNCE/HUM/035]. We are also indebted to I. Jupa and M. Walter for their professional consultation. Finally, we are very thankful to the two anonymous reviewers for their inspiring comments and detailed suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

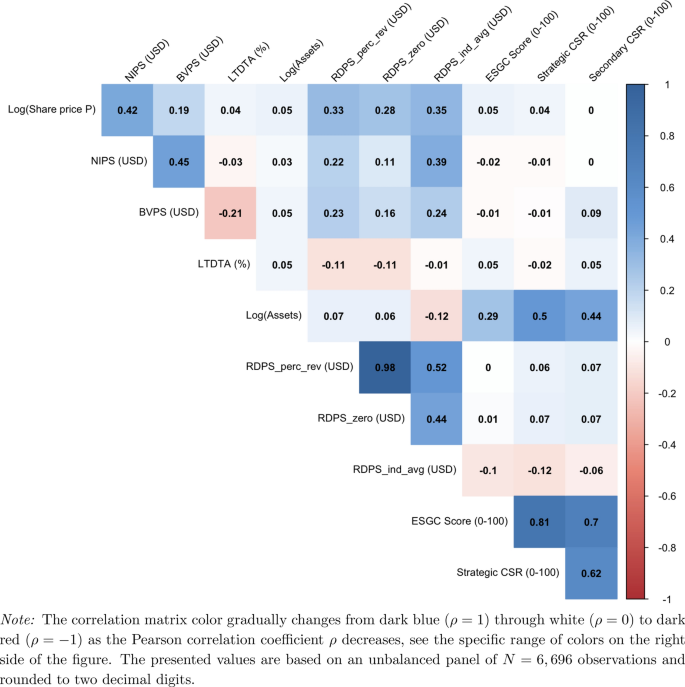

Appendix A: Multicollinearity Assessment: Correlations

Appendix B: Regression Results Con’t

Appendix C: Regression Results for the Strategic and Secondary CSR Con’t

Rights and permissions

About this article

Cite this article

Havlinova, A., Kukacka, J. Corporate Social Responsibility and Stock Prices After the Financial Crisis: The Role of Strategic CSR Activities. J Bus Ethics 182, 223–242 (2023). https://doi.org/10.1007/s10551-021-04935-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-021-04935-9

Keywords

- Corporate social responsibility

- Strategic CSR

- Business ethics

- Corporate financial performance

- Fixed effects